October 1, 2025

What Sorts Of Tornado Damage Does Property Owners' Insurance Coverage Cover?

What Does Homeowners Insurance Coverage Cover? A Complete Overview If a storm results in flooding, however, that flooding damage will certainly not be covered unless you particularly have flood insurance policy. As with your roof covering, your structure is a part of your home's framework. This suggests that any kind of structure damage triggered by a protected occasion will certainly be covered by your plan's residence insurance coverage. The NFIP motivates individuals to purchase both structure and components coverage. Flooding insurance coverage does not cover basement improvements, such as completed walls, floorings, ceilings or personal belongings that may be maintained in a cellar. For a total checklist of what's covered, check out the Requirement Flood Insurance Policy (SFIP) Forms.What sort of water damages is not covered by house owners insurance policy?

Flooding is the No. 1 all-natural calamity in the United States, yet house owners insurance coverage doesn't cover this peril. Essentially, any type of water that flows into your home from the ground isn't covered. So rain, a surging river and saturated ground aren't covered.

McAllen Storm Damage Lawyer

Moore Law Firm - Property Damage & Insurance Attorneys

Top Rated McAllen Storm Damage Lawyer

Pipeline Leak Damages That Is Not Covered

A standard home owners insurance plan might cover water damage to your basement, depending upon the source. As an example, if a burst pipeline was the source of the damages, your policy might pay to repair damage to your cellar. Nonetheless, if a flood causes damages to your basement, you likely won't be covered. It can additionally result from frozen and split pipes, leaks in your home windows, structure damages brought on by heavy rainfall, and other comparable concerns. Home insurance policies cover storm-related water damage in most cases.Throughout The Program Of The Flooding, Somebody Drove Throughout My Yard Do I Have Protection For My Lawn?

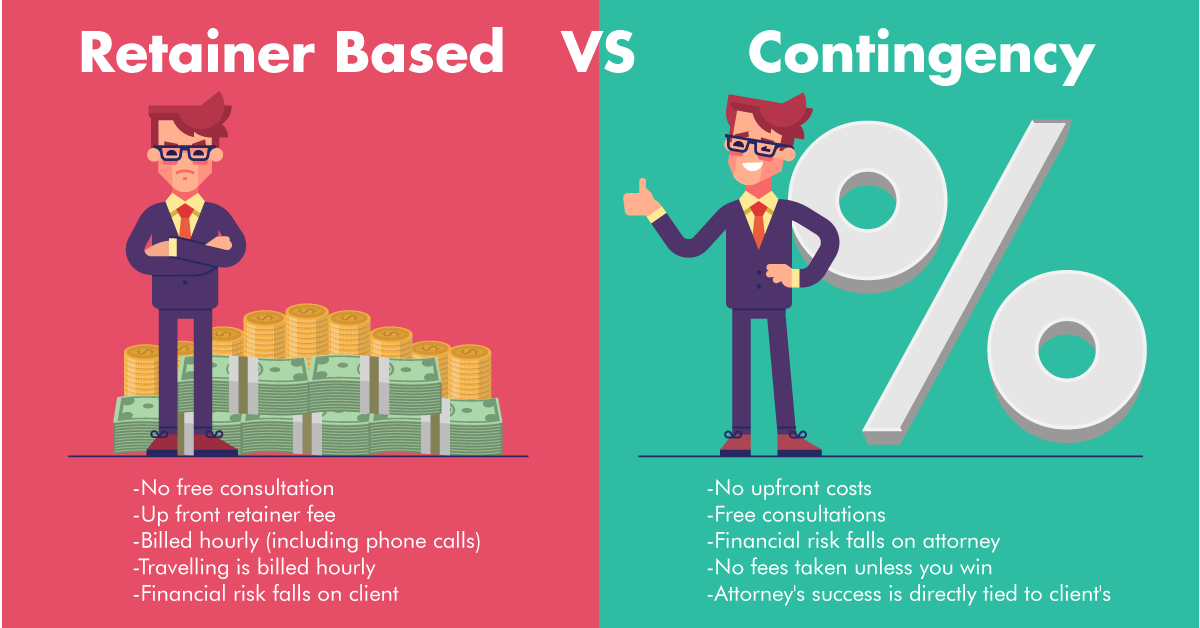

If a government disaster affirmation is released for the flood, you can put on FEMA for calamity help, whether you have insurance policy or otherwise. Kara McGinley is a former elderly editor and certified home insurance policy specialist at Policygenius, where she specialized in property owners and occupants insurance coverage. As a journalist and as an insurance policy professional, her job and understandings have actually been featured in Forbes Consultant, Kiplinger, Lifehacker, MSN, WRAL.com, and somewhere else. Yet just because your insurance claim was refuted does not imply you can not appeal the decision. Some insurers do use a limited flooding recommendation, but this is the exemption, not the policy.- While home owners insurance coverage gives essential coverage for dangers like fire, burglary, and wind damage, it does not cover flood damage.

- Whether you remain in a high-risk flood zone or otherwise, it's worth weighing the cost of coverage against the expenditure of fixings.

- Any protection for the car would certainly be supplied by the automobile insurance coverage you bring for it.

- Actually, most standard home owners insurance coverage consist of coverage for sure types of water damage-- as long as it's abrupt, unintentional, and not the result of increasing floodwater.

What Type Of Water Damage Is Covered By Home Owners Insurance?

Any kind of coverage for the automobile would certainly be provided by the vehicle insurance plan you bring for it. The normal home owners insurance coverage will not instantly offer protection versus damage or devastation brought on by quakes. If your home's electrical system (cords, outlets, electric panel, etc) are damaged throughout a covered event, it will typically be covered by your plan's structural coverage. Damages triggered by age, incorrect or absence of upkeep, or damaged craftsmanship are commonly not covered, nevertheless. The NFIP has a plan with exclusive insurer to sell and service flood insurance coverage. A checklist of exclusive insurance companies that sell and service NFIP flooding insurance coverage is available online. Note that if, throughout the life of the finance, the maps are modified and the building is currently in the risky area, your lender will certainly alert you that you should buy flood insurance. A private flooding insurance plan normally does provide insurance coverage for Extra Living Costs. A personal flood insurance coverage normally covers sump pump failing if flooding is the reason for the stop working.Social Links