October 1, 2025

Flood

Flood Insurance Coverage Taking into consideration the possible price of repairing or reconstructing your home after a flooding, this is a small rate to pay for peace of mind. Also if you're not in a risky disaster area, flooding insurance policy is still an important investment. More than 20% of all flooding insurance declares come from buildings situated beyond high-risk flood zones, implying that also homes in modest- to low-risk areas can experience flooding. All standard home owners insurance policies include personal property protection. This insurance coverage can aid you pay to repair or replace items that are damaged or damaged by a covered occasion, or which are swiped (see below). When it concerns safeguarding your home, it's necessary to recognize precisely what your homeowners insurance policy covers. Several property owners erroneously believe that their basic insurance policy will cover all kinds of damage, consisting of flooding.Why is flood insurance not consisted of in a common property owners insurance coverage?

The primary factor flooding insurance is not included in basic home insurance coverage is the basically various danger evaluation. Flooding is a local event that can create comprehensive damage to homes in specific areas while saving others.

Does Property Owners Insurance Policy Cover Water Damages?

If left unchecked mold and mildew growth can come to be more major and might trigger health-related issues and architectural damages to your home. Food resources can be anything from dry wall surface and insulation to carpeting or cushions. If you stay in an area that is vulnerable to quakes, you may want to think about buying quake insurance coverage, either as a rider on your existing policy, or as a standalone policy. You need to also take into consideration various other steps you can require to prepare your home for a quake. That being claimed, damages caused by smaller sized wild animals-- such as squirrels, raccoons, other rodents, bats, and woodpeckers-- will not generally be covered. That's because the damage caused by those pets has a tendency to happen slowly gradually. Several plans would certainly regard them to be infestations, which are generally not covered. Normally speaking, any type of various other frameworks on your home will commonly be covered against the very same hazards as your home. FEMA releases maps showing a neighborhood's flooding danger locations and the level of danger in those areas. Flooding insurance maps generally get on file in a regional repository in the neighborhood, such as the planning and zoning or design offices in the city center or the area building. Her work has actually additionally appeared in Service Expert, Money, HerMoney, PayScale, and The Muse. Nonetheless, an act of criminal damage would certainly not be covered if your home has been vacant for 60 days or even more, unless you have actually included an uninhabited home recommendation to your plan. If you are worried concerning possible wellness dangers from mold development in your home, you should seek advice from a physician. If mold growth is energetic, comprehensive, and consistent, it has the prospective to trigger illness, one of the most common of which are allergies such as wheezing, sneezing, coughing, eye irritability, etc.Does Homeowners Insurance Policy Cover Personal Effects?

- If an area heating system causes a fire in your living room and the water used by firemens problems sheetrock and flooring in nearby spaces, you can likely file a claim for that damages.

- Flood insurance policy covers overflow of inland or tidal waters and uncommon and fast build-up or overflow of surface waters from any type of resource.

- Have your policy number helpful and be prepared to answer inquiries regarding the extent and extent of the water damage.

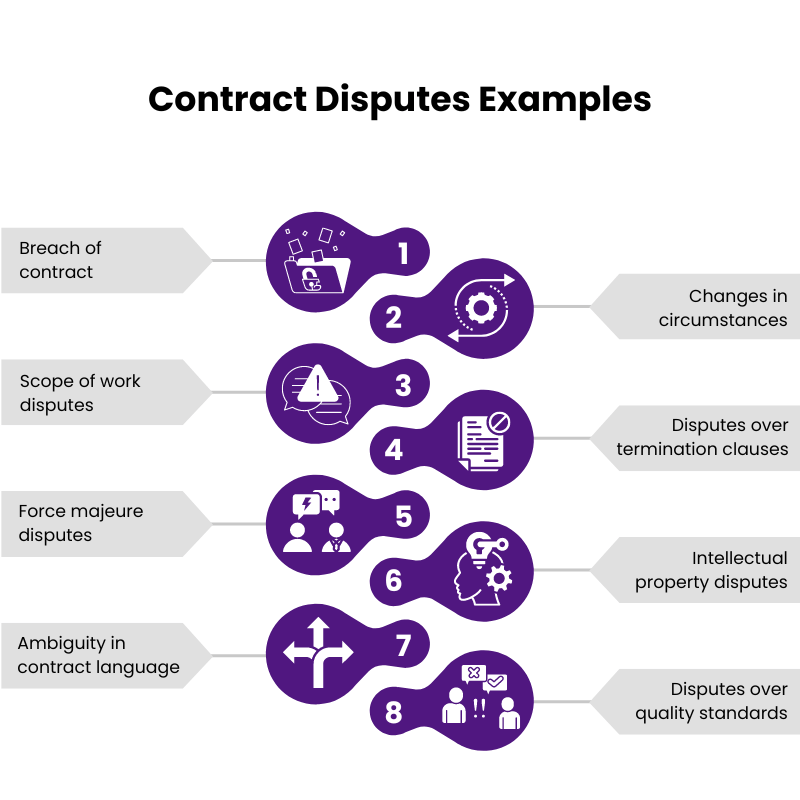

- An insurance coverage breach of contract attorney can help you test your insurance coverage provider if you believe the adjuster is inaccurately denying your claim or refusing to pay you relatively for your covered problems.

Social Links